Five Ways To Turn Spending Habits To Saving Habits With SumoTrust

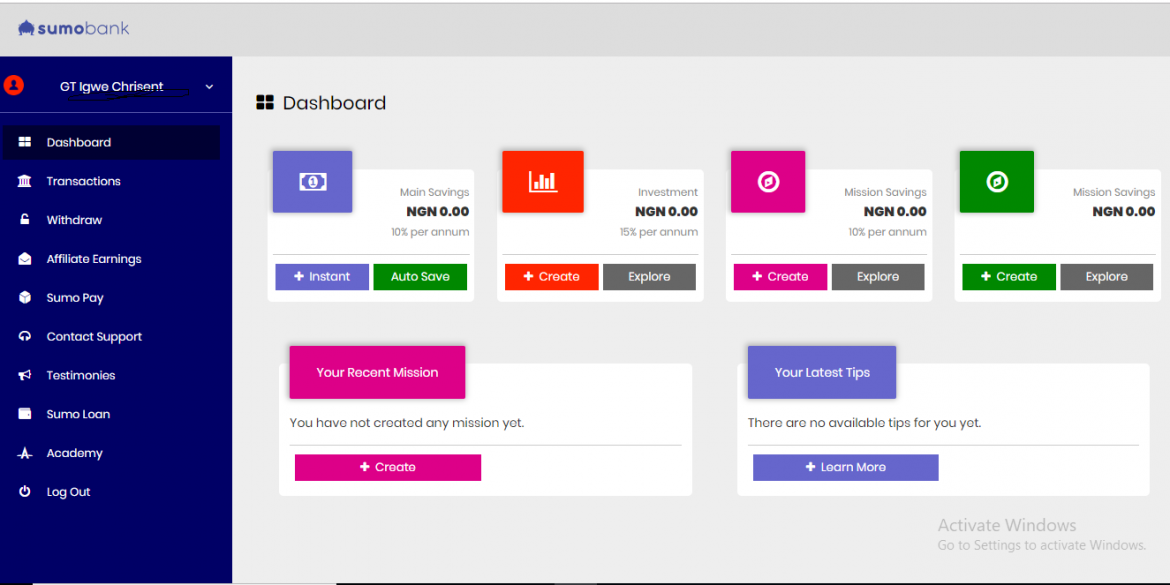

You already know that Sumotrust is a digital, trusted, and secure savings and investment platform which encourages users to save, learn, invest and earn 10-15% on savings and 24% on investment.

What you don’t know is that SumoTrust can help you turn your spending habits into saving habits with ease. I’m going to show you how. Stay with me, this is about to get interesting.

Five Ways To Save Money

This is a step-by-step guide on how to save money. We will show you in this article how you can develop a simple and realistic strategy, so you can save for all your short- and long-term savings goals with SumoTrust.

-

Budget For Spending

It is very necessary that you have an idea of what you spend in a day, weekly and monthly.

Your budget should outline how your expenses measure up to your income, so you can plan your spending and limit overspending. Aim to save 10 to 15 percent of your income.

-

Keep a record of your spending

Secondly, it is very important you keep a record of all your expenses. This will enable you to know how much you spend. Keep track of all your expenses—that means every coffee, household item, and cash tip.

Once you have your data, organize the numbers by categories, such as gas, groceries, and mortgage, and total each amount. Use your credit card and bank statements to make sure you’re accurate and don’t forget any.

-

Find A Way To Cut Your Spending

If your expenses are so high that you can’t save as much as you like to save, then you should cut your necessary expenses.

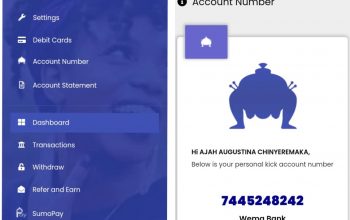

Identify nonessentials that you can spend less on, such as entertainment and dining out. Download a SumoTrust App and set a savings goal for yourself.

Also Read: Invest for future returns

Look for ways to save on your fixed monthly expenses like television and your cell phone, too.

Few ideas to help you cut your daily expenses

- Give yourself a “cooling off period” When tempted by a nonessential purchase, wait a few days. You may be glad you passed or ready to save up for it.

- Use resources such as community event listings to find free or low-cost events to reduce entertainment spending.

- Commit to eating out only once a month and trying places that fall into the “cheap eats” category.

- Cancel subscriptions and memberships you don’t use especially if they renew automatically.

-

Set savings goals

One of the best ways to save money is to set a goal. Start by thinking of what you might want to save for—perhaps you’re getting married, planning a vacation, or saving for retirement. Then figure out how much money you’ll need and how long it might take you to save it.

Here are some examples of short- and long-term goals:

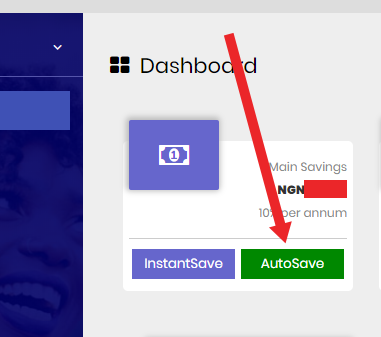

Almost all banks offer automated transfers between your checking and savings accounts. You can choose when, how much and where to transfer money or even split your direct deposit so a portion of every paycheck goes directly into your savings account.

Tip: Splitting your direct deposit and setting up automated transfers are simple ways to save money since you don’t have to think about it, and it generally reduces the temptation to spend the money instead.

Conclusion

Review your budget and check your progress every week or month. Not only will this help you stick to your personal savings plan, but it also helps you identify and fix your savings problems quickly. Understanding how to save money may even inspire you to find more ways to save and hit your goals faster.