In this article, we will be detailing down what AutoSave and InstantSave features is on Sumotrust online savings and investment platform.

These features are tech tools, that makes saving and investing on Sumotrust Smarter, easier and friendlier.

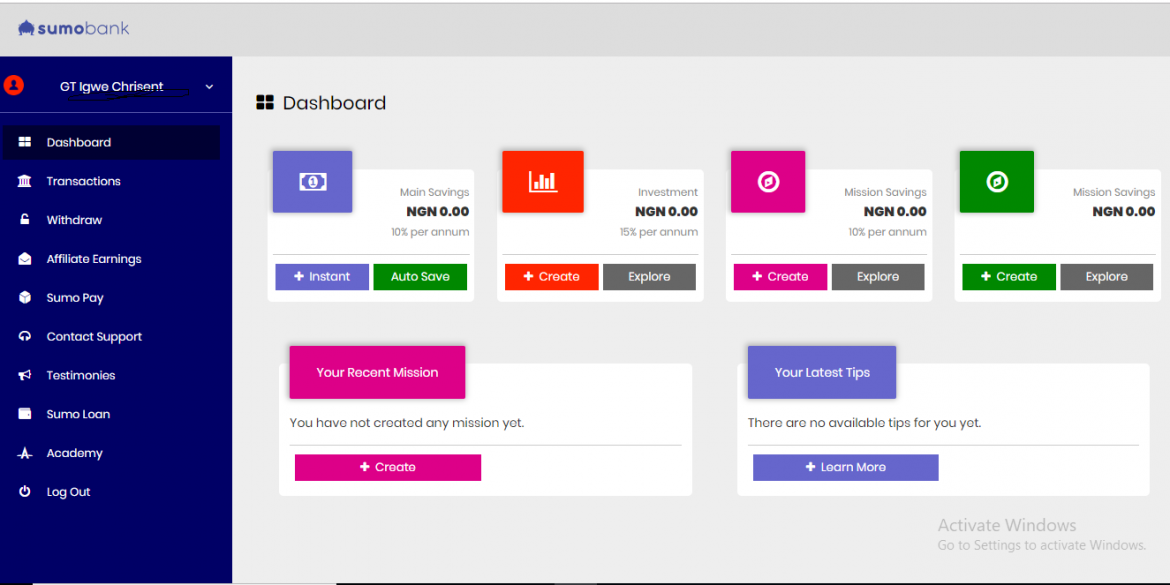

Savings Tools On SumoTrust

- What is AutoSave on Sumotrust.com?

The AutoSave feature on Sumotrust allows you to automatically set auto-debits from your debit card to your Sumotrust savings account until you reach your saving target. Debited funds can go into either your Main savings account, Fixed/Investment account or Mission savings account depending on the selection you made.

You can set the AutoSave to daily, weekly or monthly and can set the amount and exact time you want the money to be debited from your bank account to your Sumotrust account.

Related: What is sumopay?

2. What is InstantSave on Sumotrust.com?

The InstantSave option on Sumotrust allows you to add more funds to your savings account. For instance, you set an Autosave of N1000 daily and you miss a day or two because they was no money in your account or something, you can use the InstantSave option to deposit N1,000 or N2,000 at once just to ensure you meet up with the savings target that you missed.

The InstantSave option can be used on all account type (Main, Fixed and Mission account), also you can InstantSave any amount at any time per day.

Just came across careless cash after you have AutoSaved your daily target and want to save more? Go ahead and use the InstantSave option to add the money to your account.

It is best recommended not to withdraw money received into your Main Savings account through Sumopay as withdrawals on non-free withdrawal dates attract 4.5% Penalty charge.

Can somebody has different accounts like fixed saving and main account altogether ?

Yes, one can save using the different account types at a time.

Pls breakdown the features of all the Saving features on the app for instance what is mission saving? When can I withdraw from my mission saving? What is main saving and how often I can withdraw and lastly what is fixed savings ? And how often I can withdraw ????

Hello Hemsey,

thank you for your question.

Please refer to our FAQ Page here at the las question that says “What Are The Account Types On SumoTrust?” at the ‘overview’ section.

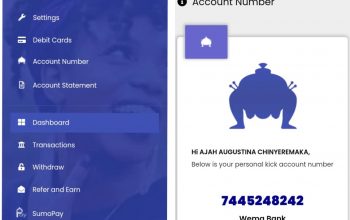

For Withdrawals, all you need to do is click on Withdraw from your account menu and select the account you want to make withdrawals from (Can be main savings, mission savings or Kick account), enter amount and other entries required. The money will be instantly sent to your bank account (you’ll get alert within 50 seconds to 3 minutes, depending on your bank)

Please throw more light on this statement

“It is best recommended not to withdraw money received into your main account from Sumopay and withdrawals out non-free withdrawal dates come with charges”

Hello Promise,

for the above statement, it means; We advise not to make careless withdrawals from funds sent to you via SumoPay as these funds are sent directly to your Main Savings account and withdrawals from main savings on non-free withdrawal dates attracts penalty fees of 4.5%, aside from that, you’re free the make withdrawal anytime.

When are the free withdrawal days and how can I set my own withdrawal day.

Free withdrawal days are; March 1, June 1, September 1 and December 1.

To set a free withdrawal date, Kindly navigate to settings from account profile and set a FREE withdrawal date from the Withdrawal date section.