In this article, we will explain the 4 types of accounts on Sumotrust which were carefully selected and named around the brand image and perception.

These accounts will help you make savings decisions while using the Sumotrust platform to save and invest.

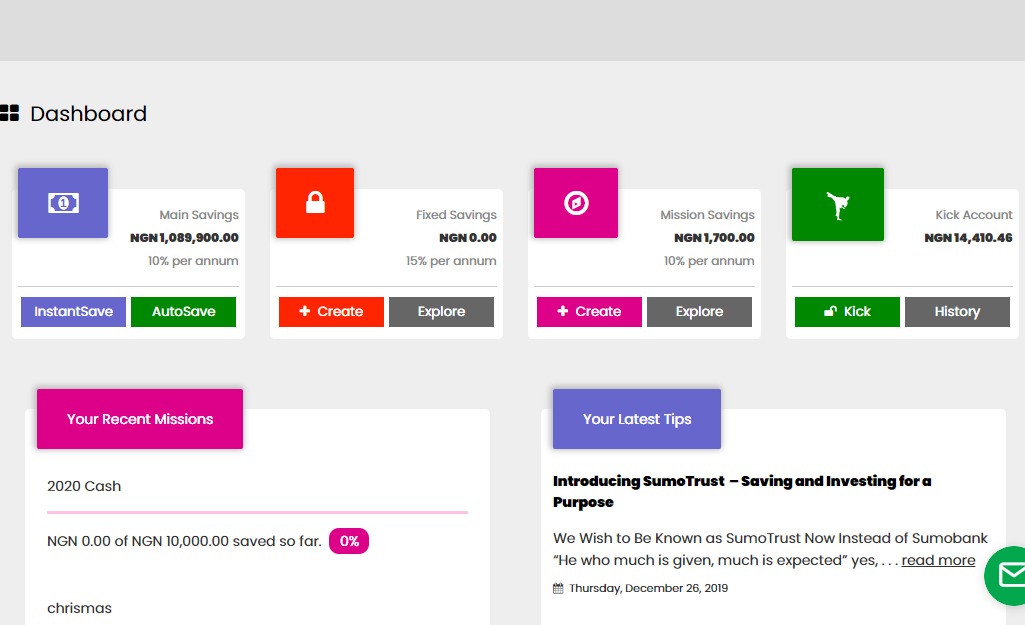

1. Main savings account

Main savings account on SumoTrust is an account type for regular savings account best for anyone who want to save and raise funds for emergency and not really tied to a particular reason. If you looking at starting a disciplined savings life, then Main savings is best for you, however, it is also best for everyone for all reasons. Automatically choose to save either on daily, weekly or monthly intervals and earn 10% interest per annum. Withdrawal here are restricted to only withdrawal dates or the exact date you choose to withdraw… In cases where you miss a saving due to insufficient balance in your account, you can IntantSave the amount missed the previous day to make it up and reach your savings goal faster.

Related: What is InstantSave and AutoSave?

One can save:

100-10000 naira Daily – Automated option

1000 – 100,000 Naira Weekly – Automated option

5000 – 5,000,000 Naira Monthly – Automated Option

2. Fixed/Investment account

The Fixed savings account on SumoTrust allows you to Securely lock away your money for a long period of time (up to 365 days) and earn up to 15% interest annually. You can Fix Save any amount.

One can save:

100-10000 naira Daily – Automated option

1000 – 100,000 Naira Weekly – Automated option

5000 – 5,000,000 Naira Monthly – Automated Option

Related: What is SumoPay?

3. Mission savings account

Want to raise money for a particular project? Set your savings mission and amount and start saving until the amount is raised. The Mission savings also allows you to create and join group savings with friends, your squad, association or join a savings challenge to reach a particular financial goal.

You can create and join multiple group savings on a mission.

Withdrawals from this account is free provided you have reached your savings target amount.

However, withdrawing money from this account type when you are yet to reach your savings goal attracts a PENALTY FEE of 4.5% charge whether private mission or group mission.

One can save:

100-10000 naira Daily – Automated option

1000 – 100,000 Naira Weekly – Automated option

5000 – 5,000,000 Naira Monthly – Automated Option

Interest Payout here is 10% Per Annum.

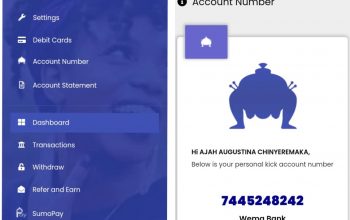

4. Kick Account

What Is Kick Account?

A Kick Account is a sub-account where all interests, affiliates/referral earnings, bonuses, etc earned on SumoTrust are paid. The bank deposits made through your Trust account numbers are also paid to your Kick Account. You can withdraw your money from it at any time, without any charges.

All withdrawals from a kick account is 100% free.